WHAT IS THE CURVE TELLING US?

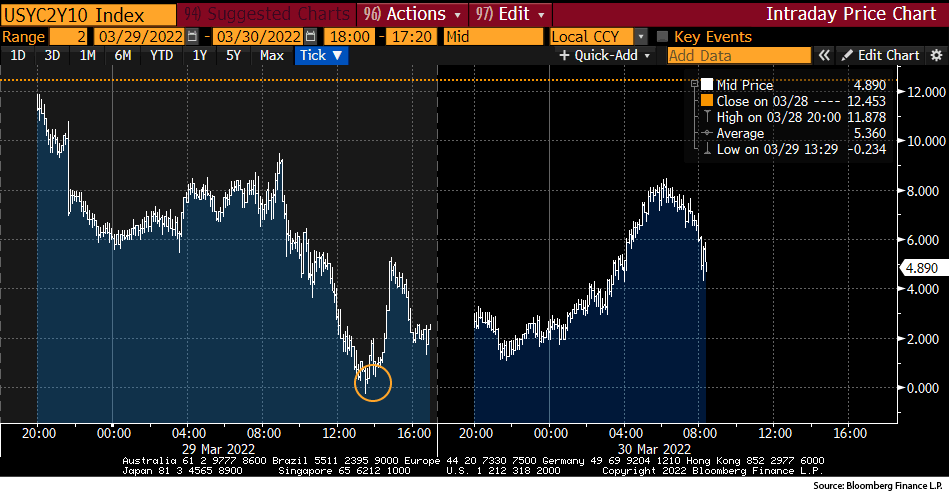

On March 29, 2022, the yield on the U.S. two year Treasury was higher than the yield on the 10 year Treasury for the first time since 2019. A few days ago, we saw an inversion in 5s to 10s. This action suggests that the rate increases that the Fed is undertaking may cause a recession.

Specifically, the inversion occurred at about 12:30 CST when the 2 year yield increased while 10 year yields decreased, crossing at a yield of 2.394%. We note that the inversion was short-lived, but it happened. A close of market with an inversion is a better indicator of recession than is an intra-day movement.

Short-term yields that are higher than long-term yields are not the norm, and an inversion signals that high levels of short-term yields are not sustainable as economic growth slows. The inversion in 2s to 10s on the Treasury curve is the latest recurrence which began last fall, when yields on the 20 year Treasury were higher than 30 year yields. In the past month, we have seen inversions come to the 7s to 10s and the 5s to 7s, also known as the belly of the curve.

Looking back, inverted curves have been a precursor to recession, but the timing of any recession is not easy to predict. It could be months or years away.

We balance the portfolios we manage by adjusting duration, asset mix, and credit weighting. Economic outlook is often a driver of asset allocation and duration management, and the impetus for change within portfolios. While we expect the volatility in the fixed income markets to continue over the near-term, we are working to counteract that volatility through active management.