A: We are counting on the world to de-carbonize, and it underpins the investment thesis for our energy sector investments. These companies constitute the vast majority our energy positioning and should be long-term beneficiaries of the energy transition.

The biggest headwind to oil demand in the energy transition should come from lower transportation fuel demand. Several developed market countries as well as China have set aggressive targets to electrify transportation. The impacts should first be felt by gasoline demand for passenger cars (20-25% of global oil demand) via increased penetration of electric vehicles (EVs), and then later by diesel demand for commercial trucks (15-20% of global oil demand) via the conversion to electric propulsion systems, hydrogen fuel cells, and compressed natural gas. While this transition will happen, the market isn’t properly accounting for three primary factors in the transition:

- First, the gasoline demand decline will take time.

Even as the EV penetration rate of new car sales accelerates in this decade, gasoline-consuming internal combustion engines with average lives of 10-15 years (or more) will remain in the global fleet for a long time. Under a confluence of ambitious regulatory incentive regimes that result in EVs representing 67% of global new car sales in 2035, EVs would still represent only 33% of the global car fleet at that time and would pose less than a 10% headwind to oil demand over the next 15 years, or less than 1% per year. This is not enough of a decline to entirely offset the traditional demand growth from other uses of oil.

- Second, oil demand is more than just passenger car demand.

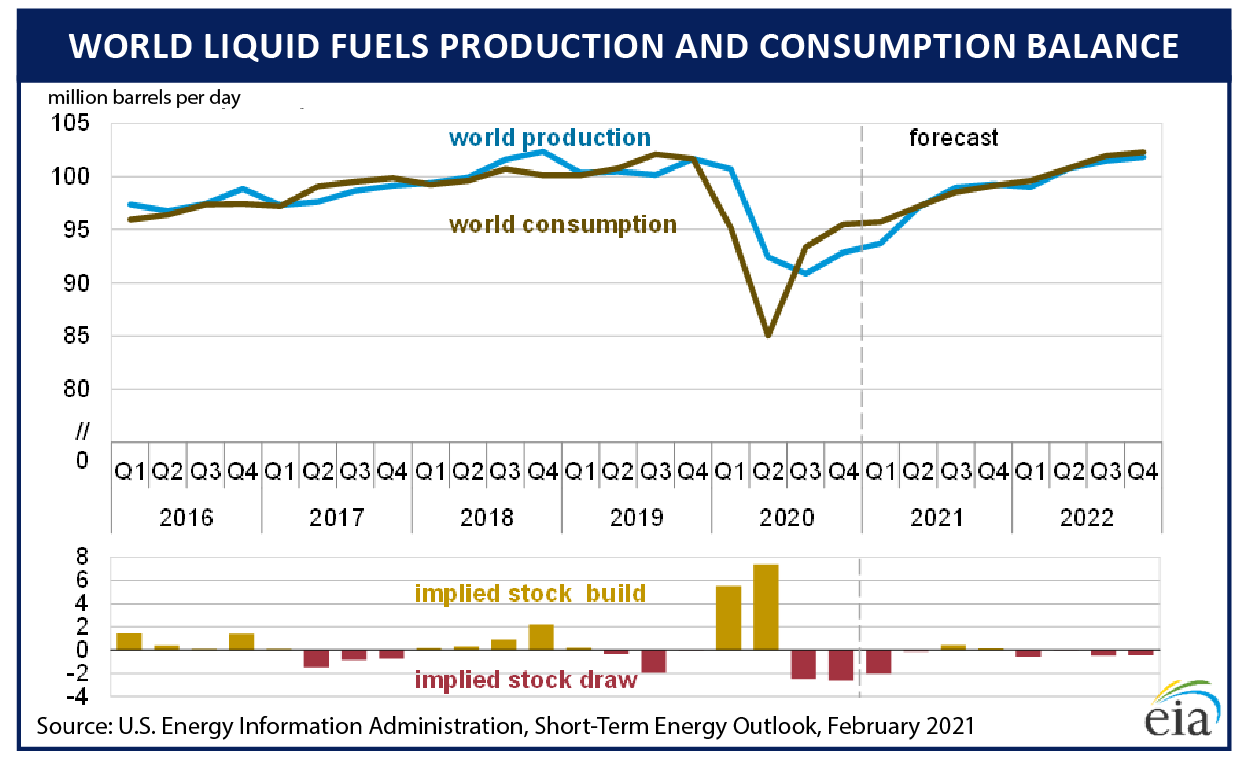

Half of oil demand is from non-transportation sources driven primarily by petrochemical and industrial uses, particularly in faster-growing non-OPEC countries. This demand continues to grow and will be more difficult to replace. In addition, the timeline to displace transportation demand for commercial diesel is longer than that of gasoline for passenger vehicles, and diesel demand will likely grow into the next decade. Even under an ambitious scenario in which governments incentivize a quick conversion of the transportation fleet away from oil, total oil demand is still likely to grow into the middle of this decade.

- Third, oil & gas production is more than just oil production.

Natural gas will be an important part of the energy transition, both as a primary energy source as well as a complement to intermittent renewable energy sources. Natural gas emits 50% less carbon than coal and emits dramatically less sulfur dioxide, nitrogen oxide, and particulate matter. Natural gas, and LNG in particular, represents a growing market that stands apart from that of traditional oil demand. Coal as a percent of the global energy mix has remained stubbornly high and the transition in Asia away from baseload coal-fired generation to baseload natural gas will be a significant driver of reduced carbon emissions and improved air quality. Examples are plentiful, and South Korea’s decision to switch 24 coal-fired power plants to LNG by 2034 underscores the transition we expect to take place, which will support continued strong demand growth for LNG for years to come.

In contrast, the decline in global oil & gas investment has been staggering. Global oil & gas investment is now 33% below 2015 levels, and the investment declines from shale producers and large independents in many cases have been even more significant. Prior levels of investment were only adequate to grow global oil supply 1-2% per year beyond offsetting natural decline rates, and the precipitous reduction in investment must now contend with underlying decline rates as high as 5%+ in conventional fields, 10%+ in offshore fields, and 30%+ in shale developments. It will be difficult to sustain current levels of oil & gas production at this lower level of investment, which suggests a shortfall in the oil & gas production required to get the world into and through the energy transition. With the end of the oil age on the horizon, investors are demanding better returns from shale and other oil producers, which requires more disciplined capital investment, which in turn will pressure global oil supply in the coming decade. While oil & gas investment needs to increase, this increase will require higher prices to incentivize that investment.